Legislation will help approximately 15,000 seniors stay in their homes

Syracuse, N.Y. – County Executive McMahon today announced that he will advance legislation to change the income qualifications for the Senior STAR Property Tax Exemption providing thousands of Onondaga County seniors with greater property tax relief.

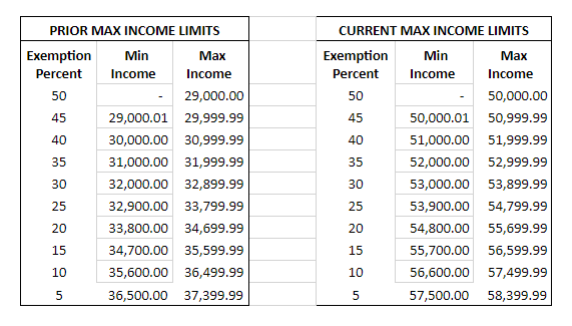

The current qualifications allow for a senior making $29,000 or less to receive a 50% exemption. On a sliding scale, a senior could make as much as $37,399 which would qualify them for a 5% exemption. Under the legislation proposed by County Executive McMahon, those income limits would change the income to receive a 50% exemption to $50,000 and a sliding scale of up to $58,399 for a 5% exemption. (Charts below to better illustrate the proposed change).

County Executive Ryan McMahon said, “My administration has worked tirelessly to lower the property tax rate for all residents of Onondaga County. In fact, since I joined county government we have cut property taxes nearly 30%.” McMahon continued, “My administration, however, is also keenly aware of the rising costs that are hitting local families, especially our seniors. That is why we were proud to provide qualifying seniors with a stimulus payment last year and why I am proud to announce this legislation which will provide additional and much needed breathing room for our local seniors on their property tax bill.”

This exemption is in addition to the Enhanced/Senior STAR exemption and must be applied for at the local town or city assessor’s office. Many seniors do not realize that this exemption is separate and in addition to the Enhanced/Senior STAR exemption so Onondaga County will be working to inform those who are eligible to apply. This legislation will be discussed at the Ways and Means Committee of the Onondaga County Legislature at their next scheduled meeting.