Get a Refund on Chase Bank Wire Transfer Fees In 4 Steps

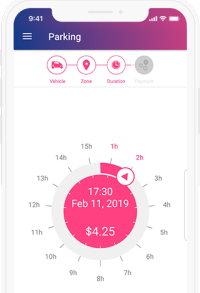

Content Why is Chase charging me a $12 service fee? Chase Bank international wire transfer times Chase international wire transfer How Much Time Do Wire Transfers Take? Incoming wire transfers received without the above information will require investigation and amendments resulting in a delay to the processing of funds to the beneficiary’s account. When I contacted Chase about the limit and how to remove it, I was told that one solution is to transfer the money into a Chase business account , then ask to have the wire limit removed. After talking to the local rep about how to do this, he told me he didn’t know, but could transfer me to the online banking department. He made it sound like he had someone in particular who would pick up the phone and take care of the issue for me. Sometimes is it more expensive to send funds internationally than it is to send them domestically. If you’ve ever had to wire money, you’ve likely been hit with a wire transfer fee. Here are our best tips for avoiding these annoying and oftentimes surprisingly expensive fees and our favorite banks which have low or no wire fees. The PSFCU does not charge any fees for incoming wire transfer and is not responsible for any fees collected by correspondents of Foreign Banks for international outgoing wires. Person-to-person services are often easy and inexpensive to use. Popmoney, for example, enables three-day standard transfers from bank accounts. ACH costs are generally lower than other popular payment methods, typically costing an average of one dollar per transaction, depending on transaction volume. Some businesses however, may have to pay a separate fee from $5 to $30 per month to use ACH for transferring money. There are also additional potential charges like return fees (from $2 to $5 per return) and reversal or chargeback fees ($5 to $25). Chase Wire transfers have one domestic wire routing number for domestic transfers and the SWIFT code for international wire transfers. Routing numbers are the core of ACH and wire transfers between financial institutions. Large banks like Chase have multiple ABA transit numbers that vary by state. Your Chase routing number is based on the state where you first opened your account. You’ll need your JP Morgan Chase ACH routing number to process ACH transfers, like setting automatic deposits and bill payments with your Chase account. Chase Bank charges wire transfer fees to cover the costs of processing the transaction. Chase charges a different fee depending on whether you’re sending or receiving the money. You’re eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ. Why is Chase charging me a $12 service fee? However, most credit unions will still charge for outgoing wire transfers, typically around $20-$25 for domestic and $40 for international. If youre not familiar with credit unions, these are local organizations. They often have better interest rates for savings and lower rates for borrowing, plus they tend to give back to the community. But they are limited in scope, with often just a few branches. If youre looking to wire money with a local credit union, learn more about the differences between banks and credit unions. Wire transfers provide the fastest way to transfer funds into your Chase Bank account. As someone looking for the best way to wire money to a friend or family member consider Wise. Wise is a simple alternative for international payments and money transfers. Are wire transfers over $10000 reported to the IRS? Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business. The Intermediary Bank information can be obtained from the beneficiary. This is not an offer to buy or sell any security or interest. Working with an adviser may come with potential downsides such as payment of fees . There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Try Veem today and enjoy the future of global business payments. Chase Bank international wire transfer times The wire transfer fees charged depend on whether you are sending or receiving wires and whether your wire transfer is domestic or international. However, for sending money internationally, you will almost definitely find a better price when sending with a specialist money transfer provider. Use our comparison engine for a real-time analysis of the best money transfer operators for your needs based on exchange rates, fees, transfer time, and more. Wire transfers provide a fast and secure method of sending money electronically. But the downside is that senders and recipients likely both have to pay a fee. Outbound wire fees can typically range from $20 to $40, while inbound fees are usually much cheaper at below $10. For a lower cost electronic transfer method, you may be better off using a payment app or mobile banking system. Send Money to Friends and Family With Zelle® Chase.com – Chase News & Stories Send Money to Friends and Family With Zelle® Chase.com. Posted: Mon, 22 Mar 2021 22:51:10 GMT [source] There are several ways to send money in 2021, depending on where and how fast you plan on doing so. GOBankingRates found 10 ways to send money online quickly and easily. Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy. After the paperwork’s finished